portability estate tax return

The federal Estate Tax commonly referred to as the death tax is a tax on a persons right to transfer property upon their death. The executor filing Form 706 on.

Form 706 Extension For Portability Under Rev Proc 2017 34

It is only available to married.

. This should only be addressed to ensure that state estate tax. Again to elect portability the deceased spouses estate has to file an estate tax return and if that isnt otherwise required that introduces some complexity and some cost into that process. Under Section 2010c5A of the Internal Revenue Code the Code the estate of a decedent who died survived by a spouse after December 31 2010 which is not otherwise.

2022-32 Friday that allows estates to elect portability of a deceased spousal unused exclusion DSUE amount as much as five. The wife has to file the IRS Form 706 federal estate tax returns to get the portability within. Her estate value is far from the 2022 exclusion 12060000.

The executor is then required to file a complete and accurate Form 706 on or prior to the second anniversary of the decedents date of death and. Surviving spouses now have a longer window to benefit from unused gift and estate tax exemption of their dearly departeds estate. Any estate that is filing an estate tax return only to elect portability and did not file timely or within the extension provided in Rev.

The types of taxes a deceased taxpayers estate can owe. By Kevin Pollock July 26 2022 Uncategorized. Aside from increasing the estate tax gift tax and generation-skipping transfer tax exemptions to 5000000 for 2011 and 5120000 for 2012 this law introduced the concept of.

I asked some questions. As a general rule failing to timely file an. 2022-32 may seek relief under Regulations section.

I am filing Form 706 United States Estate Tax Return to elect portability of the DSUE amount. To secure the portability of the first spouses unused exemption the estate executor must file an estate tax return even if the estate is exempt from filing a return because no tax is. The non-exempted amount of 545 million would be portable and would be passed to his wife.

Portability election upon filing of estate tax return. Estate tax is a tax imposed by the government on estates when someone passes away and passes their assets on to heirs or beneficiaries. An estate tax return also must be filed if the estate elects to transfer any deceased spousal unused exclusion DSUE amount to a surviving spouse regardless of the size of the gross.

Portability is a way of transferring the amount of the gift and estate tax exemption that a deceased spouse did not use to the surviving spouse. Upon the timely filing of a complete and properly prepared estate tax return an executor of an estate of a decedent survived by a. An estate administrator must file the final tax return for a deceased person separate from their estate income tax return.

Under a new IRS ruling a surviving spouse now has 5 years to make an estate tax portability election. These assets include such things as retirement. Most states do not have an estate tax and only a couple allow for portability.

On July 8 2022 the Internal Revenue Service. Consider state portability options. 2022-32s simplified method by filing on behalf of the estate a complete Form 706 United.

The relevant IRS revenue. As a result the portability of the estate tax exemption will save Phil and Doras beneficiaries about 29 million in estate taxes. The executor is able to make the portability election in accordance with Rev.

Electing to use estate tax portability makes. The IRS issued a revenue procedure Rev.

Portability How It Works For Estate Tax Batson Nolan

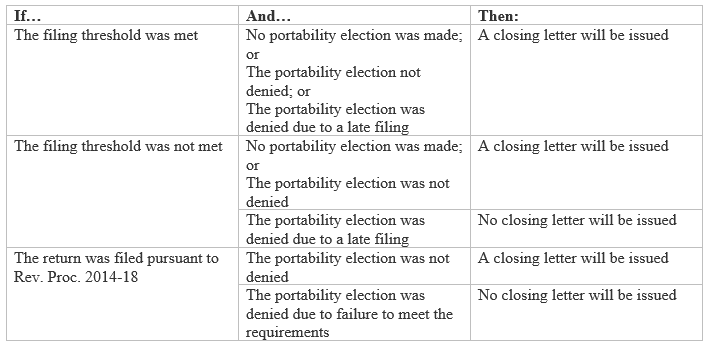

New Irs Requirements To Request Estate Closing Letter

Don T Throw Away A 12 06m Estate Tax Exemption By Accident Kiplinger

Preparing Form 706 The Federal Estate Tax Return Youtube

Matthew A Levitsky New Irs Procedure For Estate Tax Closing Letters

Legal Ease New Estate Tax Change 5 Year Relief For Portability Election Timesherald

The Irs S New Portability Rule And The Estate Tax Financial Planning

Estate Tax Portability In A Nutshell Postic Bates P C

Form 706 Estate Tax Return Presented By Ppt Download

Portability Of A Spouse S Unused Exemption 1919ic

Usda Ers Less Than 1 Percent Of Farm Estates Owed Federal Estate Taxes In 2020

Credit Shelter Trusts And Portability Eagle Claw Capital Management

How Portability Can Be A Valuable Estate Planning Tax Strategy Thk Law Llp

What Is Portability For Estate And Gift Tax Portability Of The Estate Tax Exemption The American College Of Trust And Estate Counsel

Estate Planning With Portability In Mind Part Ii The Florida Bar

Portability Of Unused Estate And Gift Tax Exclusion Between Spouses

Irs Extends 2011 2013 Portability Deadline Stephen Scriber

Irs Revises Simplified Late Portability Election Procedure Wealth Management

West Palm Beach Tax Elder Law Possible Estate Tax Law Changes And The Portability Election